Maximizing the benefits of your TD Card Services can significantly enhance your financial management and provide numerous rewards. Whether you're a seasoned user or just starting out, understanding the features and offerings of TD Card Services is crucial for optimizing your experience. This guide delves into various aspects of TD Card Services to ensure you get the most out of your credit card.

From redeeming points to utilizing digital wallets, TD Card Services offers an array of tools designed to simplify your financial transactions. With options like online banking, loans, and home lending, TD Bank provides comprehensive solutions tailored to meet both personal and business needs. By exploring these services, you'll gain insights into how they can be leveraged effectively for maximum advantage.

Customer Support Access

Engaging with TD Card Services starts with reaching out to their dedicated customer support team. If you have any queries or require assistance, contacting them directly at 1-888-561-8861 ensures prompt resolution. The team is equipped to handle inquiries ranging from account updates to transaction disputes, ensuring that all concerns are addressed efficiently.

Beyond phone support, TD Card Services also offers multiple channels for communication, including email and live chat options available through their website. These platforms allow users to interact conveniently without being confined by traditional office hours. Such accessibility fosters a seamless interaction between customers and service providers.

For those who prefer face-to-face interactions, visiting local TD Bank branches remains another viable option. Here, representatives can offer personalized guidance based on individual needs while maintaining privacy during consultations. This multi-faceted approach underscores TD's commitment to providing exceptional customer care.

Reward Redemption Process

Accumulating TD Points through purchases made using your TD Travel Credit Card opens up opportunities for reward redemption. These points serve as currency within the TD Rewards program, allowing cardholders to exchange them for valuable perks such as travel vouchers, merchandise, or even cash back.

To initiate the redemption process, log into your account via the TD Bank portal where detailed instructions guide you step-by-step towards selecting desired rewards. Users may choose from a variety of options depending on accumulated point balances; this flexibility enhances satisfaction levels among participants.

In addition to standard redemptions, special promotions occasionally enhance value propositions further by offering bonus points or exclusive deals accessible only to loyal members. Keeping abreast of these updates helps maximize returns on everyday spending activities.

Financial Transparency Reporting

TD Card Services maintains transparency in its operations by regularly publishing financial reports highlighting expenditures across different sectors. For instance, under categories like Parks, Recreation & Tourism, Public Services, Supplies, and Other Boo In The Zoo, total expenses amounted to $2,329.82 during July 2024. Such disclosures foster trust between the institution and its stakeholders.

Furthermore, segments related to Fire Services and Travel & Training reflect broader commitments towards community safety and employee development initiatives respectively. By categorizing costs meticulously, TD Card Services enables clear visibility into resource allocation patterns thereby reinforcing accountability practices.

These reports not only serve informational purposes but also aid strategic planning efforts aimed at improving operational efficiencies moving forward. They invite constructive feedback from observers which contributes positively toward continuous improvement processes within the organization.

Digital Payment Integration

Integrating TD Cards into digital wallets represents a significant advancement in payment technology offered by TD Card Services. Adding your TD cards to mobile devices streamlines transactions whether shopping online, making in-store purchases, or engaging in-app commerce. This convenience factor appeals strongly to tech-savvy consumers seeking effortless payment methods.

The inclusion of Visa capabilities extends compatibility across global networks ensuring widespread acceptance wherever Visa is honored worldwide. Security measures implemented safeguard sensitive data against unauthorized access thus instilling confidence amongst users when adopting new technologies.

As part of ongoing enhancements, TD continues exploring innovative ways to integrate emerging trends like biometric authentication enhancing user experience while maintaining robust security protocols essential in today’s digital landscape.

Comprehensive Banking Solutions

Welcome to TD Bank—a hub for diverse banking services encompassing everything from basic accounts to sophisticated investment products catering specifically to individuals and businesses alike. At TD Bank, we pride ourselves on delivering tailored solutions addressing unique financial requirements through our extensive portfolio comprising savings plans, mortgage financing, small business loans, retirement funds etc.

Credit cards remain integral components within this ecosystem offering flexible credit lines alongside attractive incentives encouraging responsible usage habits. Our diverse range includes travel-focused cards rewarding frequent flyers along with cashback variants appealing broadly across demographics.

Homeowners benefit immensely too through competitive rates provided under our mortgage programs enabling dream homes acquisition dreams come true faster than anticipated. Partnering closely with clients throughout their journey ensures long-term success achieved collaboratively rather than independently.

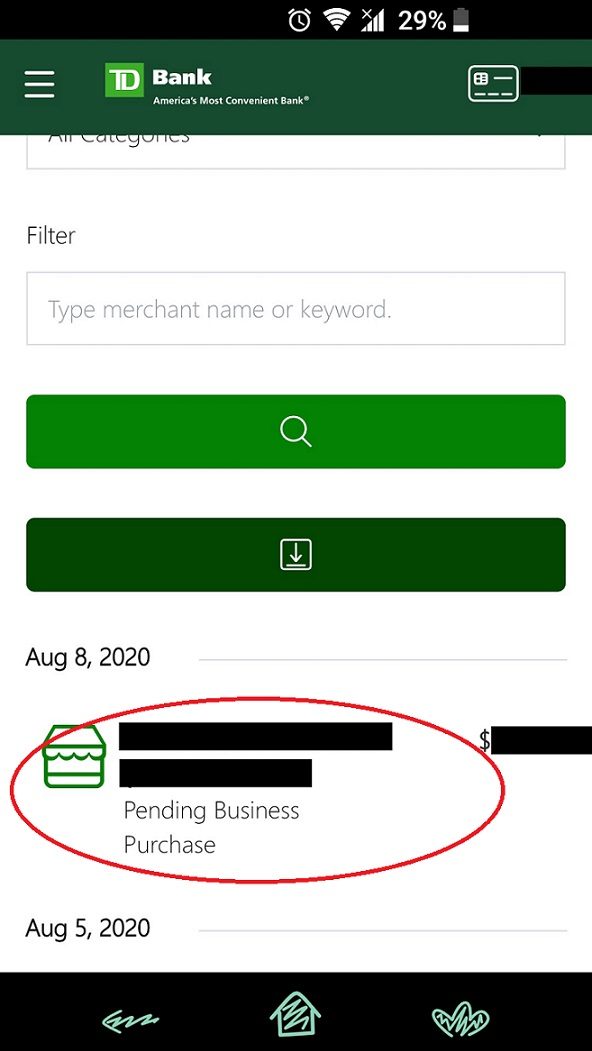

Transitioning Platforms

A notable change occurred concerning platform accessibility regarding TD Card Services. Effective January 15th, 2022, TDCARDSERVICES.COM ceased functioning redirecting users instead to tdbank.com for continued servicing needs. While intended simplification might streamline processes theoretically, practical implications necessitate careful consideration especially regarding timely bill payments.

Potential disruptions could arise if migration isn't handled smoothly potentially leading to late fees unless mitigated proactively. To avoid such pitfalls, it becomes imperative for affected parties to familiarize themselves thoroughly with updated procedures outlined clearly upon notification receipt.

Despite initial apprehensions surrounding transitions, proactive engagement coupled with effective communication channels established beforehand alleviates much anxiety associated typically with system changes. Leveraging available resources equips users better handling inevitable adjustments confidently.

Phishing Awareness

Be vigilant against fraudulent schemes impersonating legitimate entities like TD Card Services attempting deceitful means to extract personal information illegally. Scammers often employ tactics sending unsolicited emails purportedly originating from official sources requesting urgent actions supposedly necessary protecting accounts.

Always verify authenticity before responding never divulging confidential details prematurely unless absolutely certain identity verifications confirm genuine requests indeed received. Cross-referencing contact numbers independently sourced outside suspicious correspondence proves prudent safeguarding against potential scams lurking cyberspace.

Educating oneself continuously about prevalent threats empowers individuals combating cybercrime effectively reducing risks exposure considerably. Staying informed equates taking charge own cybersecurity thereby promoting safer online environments beneficial collectively everyone involved.