In today's fast-paced world, managing finances effectively is crucial for achieving financial freedom. One of the key tools that can help you take control of your financial life is TDCardServices. Whether you're looking to simplify bill payments, monitor transactions, or explore credit card options, TDCardServices offers a comprehensive suite of features designed to meet your needs. Let's delve into how this platform can empower you to manage your finances more efficiently.

TDCardServices provides an all-in-one solution for managing TD Bank credit cards online. From paying bills to disputing charges, everything can be done conveniently through their user-friendly interface. This article will guide you through maximizing your financial freedom with TDCardServices by revealing top tips and benefits. Discover how easy it is to stay on top of your finances and enjoy the flexibility that modern banking solutions offer.

Accessing and Managing Your TD Credit Card Account Online

Streamlining Your Financial Management

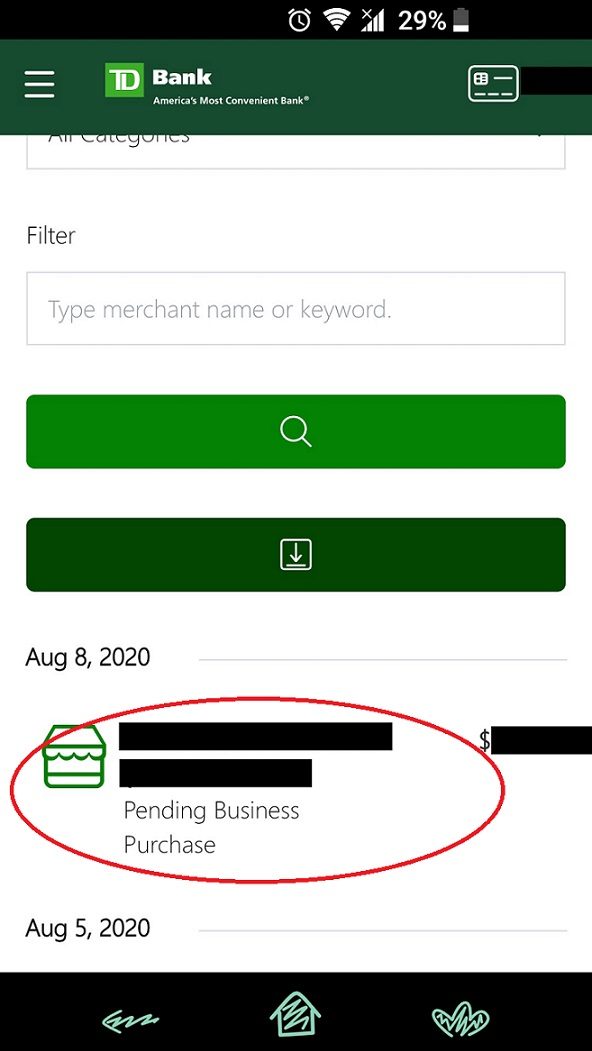

The TDCardServices login portal serves as your gateway to managing all aspects of your TD Bank credit card services. By logging in, you gain access to a range of functionalities that allow you to stay informed about your account status, view transaction history, and make timely payments. This level of accessibility ensures that you never miss a payment deadline, helping you maintain a healthy credit score.

Through the TDCardServices platform, users can effortlessly navigate their accounts and take advantage of various tools tailored to enhance financial management. For instance, setting up automatic payments ensures that your bills are paid on time without requiring constant reminders. Additionally, you can monitor your spending patterns by reviewing detailed transaction reports, enabling smarter budgeting decisions.

Beyond basic account management, the portal also offers resources for improving financial literacy. Educational materials and personalized insights provide valuable guidance on optimizing credit usage and building wealth over time. These features empower users to take proactive steps toward achieving long-term financial goals while maintaining short-term stability.

Paying Your TD Card Services Bill Online

Convenient Payment Options at Your Fingertips

With Doxo, paying your TD Card Services bill has never been easier. This versatile platform allows you to settle outstanding balances using multiple payment methods, including credit cards, debit cards, Apple Pay, or direct transfers from your bank account. The convenience of being able to pay from any device makes managing finances hassle-free, no matter where you are.

Doxo streamlines the payment process by offering secure and efficient ways to transfer funds. Users can schedule recurring payments to avoid late fees or make one-time payments when needed. The intuitive interface ensures that even those unfamiliar with digital banking can quickly adapt and start enjoying the benefits of online bill payments.

Moreover, Doxo integrates seamlessly with other financial applications, providing a holistic approach to money management. By consolidating all your bills in one place, you gain better oversight of your overall financial health. This integration not only simplifies payment processes but also enhances organization and reduces the risk of overlooked obligations.

Credit Bureau Dispute Process

Addressing Discrepancies in Your Credit Report

If you encounter discrepancies in your credit report related to TD Retail Card Services, rest assured that there is a straightforward process for resolving these issues. Mailing disputes to TD Retail Card Services at PO Box 100270 in Columbia, SC, ensures that your concerns are addressed promptly and accurately. Each dispute receives careful consideration to rectify any errors affecting your credit standing.

When initiating a credit bureau dispute, it's essential to provide clear documentation supporting your claim. This might include copies of receipts, invoices, or correspondence with merchants involved in the transactions under question. Thorough preparation increases the likelihood of successful resolution and helps expedite the process.

TD Retail Card Services remains committed to maintaining accurate records and assisting customers in safeguarding their credit profiles. Their dedicated team works diligently to investigate disputes and implement necessary corrections, reinforcing trust between the institution and its clients. Understanding this process empowers you to protect your financial reputation effectively.

Leadership Excellence at TD Card Services

Fostering Growth Through Effective Leadership

Claude Sears, Jr., Vice President and Group Manager at TD Card Services, exemplifies the qualities of an engaging leader who drives both personal and organizational success. With extensive experience in people management, coaching, and mentorship, Claude focuses on nurturing talent within his teams to achieve exceptional results. His leadership style emphasizes fostering an environment where individuals thrive professionally while contributing positively to business outcomes.

Under Claude's guidance, leaders receive comprehensive training aimed at enhancing skills critical for delivering excellence in both business operations and personal lives. This approach cultivates a culture rooted in positivity, engagement, discipline, and continuous improvement. Employees benefit from mentorship programs designed to accelerate career growth while aligning individual aspirations with corporate objectives.

Based in Greenville-Spartanburg-Anderson, South Carolina, Claude leverages his education from ITT Technical Institute alongside hands-on industry expertise to inspire innovation across TD Card Services. His commitment to developing future leaders reflects TD Bank's dedication to maintaining high standards of service excellence and customer satisfaction throughout its operations.

Exploring TD Bank Credit Card Options

Enhancing Your Financial Arsenal with Diverse Credit Cards

TD Bank offers three distinct credit card options catering to diverse consumer preferences: TD First Class Travel Visa Infinite Card, TD Aeroplan Visa Infinite Card, and TD Cash Back Visa Infinite Card. Each card comes equipped with unique benefits tailored to suit varying lifestyles and spending habits. Whether prioritizing travel rewards, accumulating miles for flights, or earning cash back on everyday purchases, TD Bank has a solution that aligns perfectly with your financial priorities.

As a subsidiary of Toronto-Dominion Bank headquartered in Cherry Hill, New Jersey, TD Bank continues expanding its portfolio of financial products to meet evolving customer demands. Their commitment to innovation ensures that clients have access to cutting-edge tools and resources necessary for navigating complex financial landscapes confidently. Exploring these credit card offerings opens doors to new opportunities for maximizing value through strategic credit utilization.

Applying for TD Bank credit cards is straightforward, allowing potential applicants to evaluate which option best suits their needs before committing. Once approved, users gain immediate access to exclusive perks such as sign-up bonuses, introductory APR rates, and enhanced security features. Leveraging these advantages positions cardholders favorably in pursuing financial independence and prosperity.

Discover Comprehensive Banking Solutions

Navigating TD Bank's Range of Financial Products

Welcome to TD Bank—a premier destination for exploring an extensive array of banking services, credit cards, loans, home lending options, and specialized financial products crafted specifically for individuals and businesses alike. As part of the global Toronto-Dominion Bank network, TD Bank delivers unparalleled reliability and expertise in meeting diverse financial requirements.

From establishing checking accounts to securing mortgages, TD Bank's comprehensive suite of offerings caters to every stage of life's journey. Customers appreciate the seamless integration of traditional banking practices with modern technological advancements, ensuring convenience without compromising security or service quality. Furthermore, personalized advisory services empower clients to make informed decisions aligned with their unique circumstances.

Commitment to transparency underscores TD Bank's operational philosophy, evident in regular updates like the July 2024 Transparency Report detailing expenditures across departments such as Parks, Recreation & Tourism, Public Services, Supplies, Fire Services, and Travel & Training. Such openness fosters accountability and strengthens relationships built on mutual trust between TD Bank and its valued clientele.