Uncover Broward County Real Estate Tax Records: A Comprehensive Guide to Saving on Property Taxes. In the realm of real estate, understanding property taxes is crucial for homeowners and investors alike. Whether you're a seasoned property owner or just beginning your journey in real estate, navigating the intricacies of property taxes can significantly impact your financial planning. This guide aims to demystify Broward County's real estate tax records, offering insights and strategies to help you save on property taxes.

Broward County, located in Florida, offers a wealth of resources for those looking to delve into its public records and property tax system. By exploring these resources, you can gain a deeper understanding of how property taxes are assessed and managed within the county. This article will provide a detailed overview of Broward County's property tax processes, highlighting key aspects such as public records access, property appraisal, and common probate mistakes to avoid.

Accessing Broward County Public Records

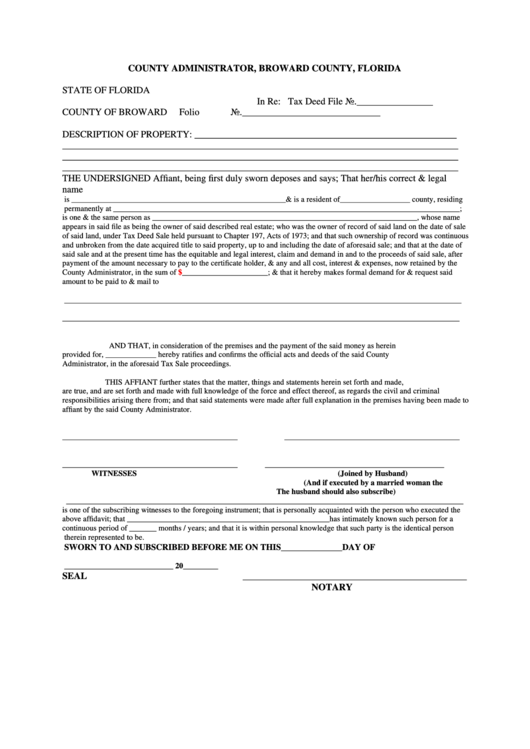

Broward County provides extensive access to public records through various online platforms. The NETR Online service allows residents and stakeholders to search Broward records, including property tax information. This platform serves as a gateway to Florida property searches and assessor data, making it easier for individuals to retrieve necessary documents and details about properties within the county.

The availability of Broward public records extends beyond just property tax data. It encompasses a wide array of information that can be invaluable for legal, financial, and personal purposes. By utilizing these resources, users can ensure they have accurate and up-to-date information regarding their properties, helping them make informed decisions about investments and ownership.

Moreover, the transparency provided by Broward County's public records fosters accountability and trust between government entities and citizens. This openness encourages responsible property management and ensures that all parties involved in real estate transactions have access to the necessary information to proceed confidently.

Understanding the Broward County Property Appraiser's Role

The official website of the Broward County Property Appraiser, Marty Kiar, is a vital resource for anyone interested in property values and assessments. Through the Quicklinks feature, users can quickly navigate to essential sections that detail the appraisal process and provide current market data. Understanding how properties are appraised is fundamental to managing property taxes effectively.

Property appraisals play a critical role in determining tax liabilities. They involve evaluating the value of properties based on market conditions, location, and other relevant factors. By staying informed about appraisal methods and results, property owners can better anticipate and manage their tax obligations, potentially identifying opportunities for reductions or exemptions.

In addition to providing appraisal services, the Broward County Property Appraiser's office also offers educational resources and tools to assist property owners in understanding their rights and responsibilities. This support empowers residents to engage actively in the tax assessment process, ensuring fair and equitable treatment.

Exploring Job Opportunities in Records and Treasury

The Broward County Board of County Commissioners frequently seeks qualified candidates for positions related to records, taxes, and treasury management. These roles often include responsibilities tied to real estate taxes, offering professionals an opportunity to contribute directly to the administration and oversight of property tax systems within the county.

Candidates interested in these positions should possess strong analytical skills and a thorough understanding of tax regulations and record-keeping practices. Working in this field requires attention to detail and the ability to manage complex datasets, ensuring that all property tax records are maintained accurately and efficiently.

By joining the team responsible for managing Broward County's property tax operations, individuals can play a pivotal role in shaping the future of local taxation policies and practices. This involvement not only enhances professional growth but also contributes to the overall economic stability and development of the community.

Avoiding Common Probate Mistakes in Broward County

In handling probate cases within Broward County, several common mistakes can complicate the process and lead to unnecessary delays or expenses. One significant issue involves improper management of property taxes during estate settlements. Ensuring all taxes are paid before distributing assets to heirs is crucial to avoiding legal disputes and financial penalties.

Poor record keeping is another frequent pitfall in probate proceedings. Maintaining meticulous records of all financial transactions, including property tax payments, is essential for facilitating smooth estate administration. Accurate documentation helps prevent misunderstandings and ensures compliance with legal requirements.

Additionally, missing deadlines for filing necessary paperwork can severely hinder the probate process. Staying organized and adhering to established timelines is paramount to achieving efficient and effective estate settlement. By addressing these potential issues proactively, executors can safeguard the interests of all parties involved and streamline the probate procedure.

Managing Property Tax Payments in Broward County

Property tax bills in Broward County are accessible online, allowing residents to view, print, and pay their taxes conveniently. Various payment options are available, catering to different preferences and needs. This flexibility ensures that taxpayers can fulfill their obligations promptly and without complications.

For those who prefer traditional methods, alternative ways to pay property tax bills are also provided. These options include in-person payments at designated offices or through mail services. Regardless of the chosen method, paying property taxes on time is essential to avoid penalties and maintain good standing with local authorities.

As part of ongoing efforts to improve service delivery, Broward County continuously updates its systems and procedures to enhance user experience. By leveraging technology and adopting modern solutions, the county strives to make property tax management as seamless and efficient as possible for all stakeholders.

Updates on 2024 Property Tax Bills

The Records, Taxes & Treasury Division has recently announced the mailing of property tax bills for 2024. Payments are now being processed, marking the start of the annual tax collection cycle. This update underscores the importance of timely submission of tax payments to avoid any potential disruptions or additional charges.

Taxpayers are encouraged to review their bills carefully and verify the accuracy of the information provided. Any discrepancies should be reported immediately to ensure corrections are made swiftly. Staying informed about tax bill details helps property owners stay compliant and prepared for future financial commitments.

With the advent of digital tools and enhanced communication channels, Broward County continues to refine its approach to property tax management. These advancements aim to foster greater transparency and accessibility, empowering residents to take control of their tax responsibilities and contribute positively to the community's fiscal health.